For example, most mortgages are ordinary general annuities, where payments are made monthly and interest rates are compounded semi-annually. As with car loans, your first monthly payment is not required until one month elapses. With an immediate annuity, you pay the insurer a lump sum and start collecting regular payments right away. Some older adults, for example, may choose to put some of their nest egg into an annuity once they hit retirement to ensure a regular income stream.

Best for fixed annuity

Since they don’t have as much time to accumulate interest, though, the payments are usually smaller. The period after you purchase an annuity and it starts to earn interest is known as the accumulation phase. Nationwide was third for customer service among major annuity providers, right behind F&G and MassMutual. Similarly, the formula for calculating the PV of an annuity due takes into account the fact that payments are made at the beginning rather than the end of each period. The reason the values are higher is that payments made at the beginning of the period have more time to earn interest. For example, if the $1,000 was invested on January 1 rather than January 31, it would have an additional month to grow.

Annuity in Advance vs. Annuity in Arrears

You can select a joint annuity which will give a guaranteed income for both you and your named spouse or partner for the rest of your lives. You should bear in mind that adding some of these benefits to your annuity can have significant impact on the level of income you receive. They are lower risk because the interest rate and payment amount don’t change. Variable annuities produce income based on the performance of sub-accounts, which are usually stock or bond investment funds chosen by the annuitant.

- If the contract specifies the period in advance, we call it a certain or guaranteed annuity.

- However, the rules of the annuity plan still govern all matters and may override certain rules.

- There are annuities with minimum initial payments of $100,000 and some as low as $2,500.

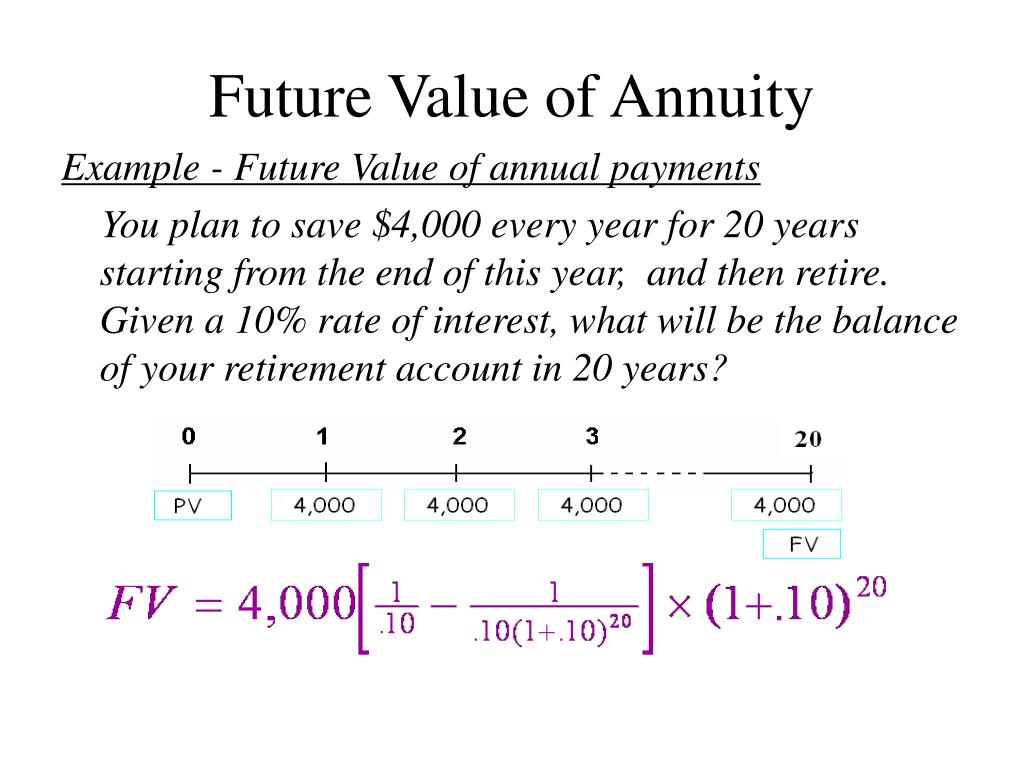

Saving for retirement with annuities

When you die the annuity dies with you unless you select a death benefit or second annuitant. These features can include value protection or guarantee periods. Plus, you could choose to include an annuity payable to a named second annuitant should you die before them. A partner can be a registered civil partner or financially dependent partner.

Life tables are used to calculate the probability that the annuitant lives to each future payment period. Annuity due refers to a series of equal payments made at the same interval at the beginning of each period. Periods can be monthly, quarterly, semi-annually, annually, or any other defined period. Examples of annuity due payments include rentals, leases, and insurance payments, which are made to cover services provided in the period following the payment.

One choice is to convert the pension funds you’ve built up into a guaranteed regular income. Guaranteed Rates—The payout from variable annuities depends on how the market performs, but with the fixed type, you know what your rate of return will be for a certain period of time. For older adults looking for a predictable income stream, that may be a better alternative than putting money into equities or even corporate bonds.

If the contract specifies the period in advance, we call it a certain or guaranteed annuity. An ordinary annuity can be any financial obligation that requires periodic payments made at the end of a period. Mortgages and car loans are ordinary annuities because you pay those in arrears, usually starting 30 or more days after the loan funds. The four main types of annuities are immediate annuities, deferred annuities, fixed annuities, and variable annuities.

The reason for this is that the present value of future cash payments depends on the interest rate used in calculating the present value. When the time value of money (TVM) changes, the annuity valuation changes as well. Other examples of this concept are the semiannual interest payments made on a bond or quarterly or annual dividend payments. While the term “in arrears” is part of “annuity in arrears,” their meanings are vastly different. Another way of describing annuity in arrears is a series of periodic, recurring payments that are due at the end of a predetermined period.

You may also find equity-indexed annuities, where payments are adjusted by an index. An ordinary annuity is a series of equal payments made annuity in advance at the end of consecutive periods over a fixed length of time. An example of an ordinary annuity includes loans, such as mortgages.